Table of Content

You should not simply rely on a telephone call being recorded, or being given the name of the adviser you have spoken to. This will not be sufficient evidence to support your claim that you disclosed. However, please note that there remain some particular situations where it continues to be difficult to find insurance if you have convictions. In particular, certain types of commercial insurance and/or people with convictions for sexual offences.

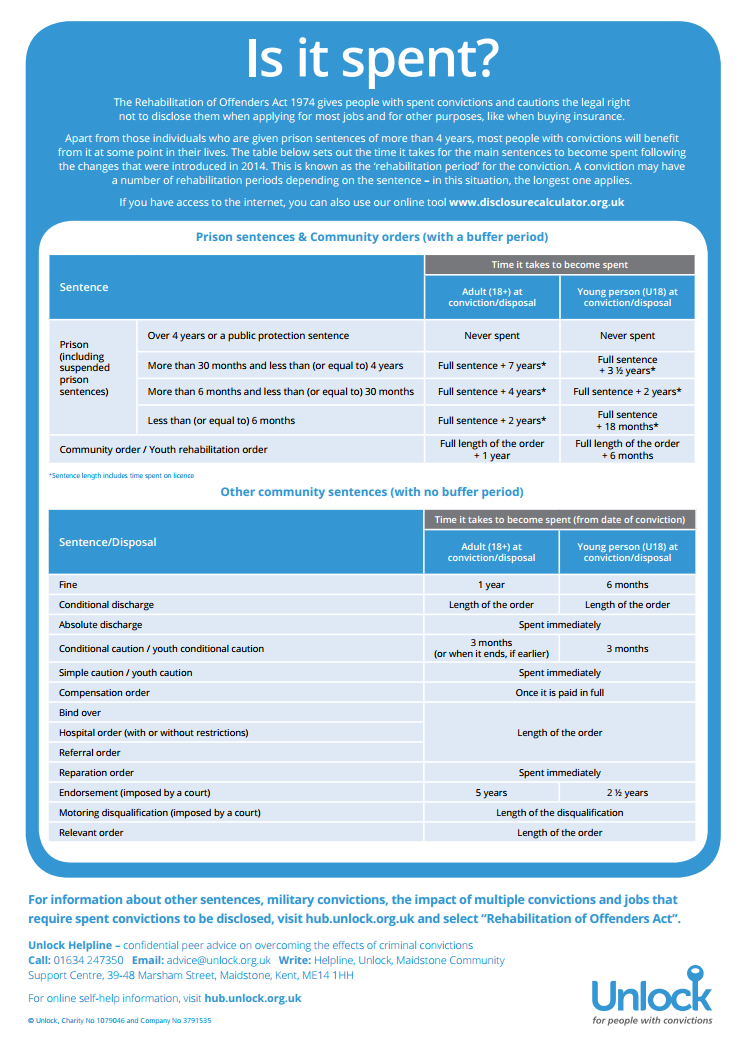

These particular convictions are classified as ‘spent’ once a specified amount of time has lapsed since the incident occurred. To slightly complicate matters, where the court imposes more than one sentence or penalty for the offence, the longest rehabilitation period determines when the conviction will become spent. The law recognises that it would be unfair to hold past mistakes against you forever. Under the Rehabilitation of Offenders Act 1974, most convictions become “spent” after a certain number of years. When the conviction becomes spent, you no longer have to declare it to an insurer. The renewal date of your policy is also a time to let your insurer know about any convictions you’ve had in the last 12 months, as it might affect the renewal premium.

Can you be sacked for a spent conviction?

It is better that you disclose your conviction than to have your job coach do it. Price-comparison websites tend to ask you to disclose more information because they’re asking questions on behalf of a range of insurance companies, each of which will have different acceptance criteria. For other convictions it may or may not offer cover depending on factors such as classification, the number of penalty points, whether the driver was banned and for how long.

This means the cheapest policies are unlikely to be available to you. Insurers will ask you about the convictions of everyone who is going to be covered by the insurance, such as your partner or children. You will need to declare if anyone living in your home has unspent convictions. If a DBS check reveals you have an unspent conviction that you failed to declare to your insurer, your insurance policy will become void and your claim will be refused. If you have involved with undisclosed criminal conviction you have to not ordinarily do with the type of.

Unspent convictions that means or law

This is more likely to happen if the conviction was obtained during the policy. It simply means you don’t fit within their underwriting guidelines. For example, if SAGA chose not to offer a quote to a 25 year old, that person has not been refused insurance. Use the Disclosure Calculator to find out when your criminal conviction will become ‘spent’. If therefore, describing the disciplinary action or dismissal would result in also revealing the existence of the spent conviction, then you are not obligated to discuss what happened in your previous workplace. You could be asked to pay the insurer an extra sum of money, equal to the higher premium they would have charged if they had they been aware of the conviction.

Failure to declare unspent convictions when asked to do so can invalidate your insurance policy. For this reason, it is a good idea to ask your insurance provider for a written confirmation of any criminal conviction declarations that you make to them. Keep this as evidence of disclosure in case you need to make a claim. As a charity, we have focused on increasing access to insurance for people with convictions. As a result, rather than becoming a provider ourselves, we have sought to increase provision elsewhere, driving up competition, resulting in prices being driven down. However, we do publish a list of specialist insurance brokers who can help people with unspent convictions.

Your property

If you're still in your rehabilitation period following a criminal conviction, your conviction is unspent. Any custodial sentence over two and a half years stays unspent. If you were found guilty of a criminal offence by a court, following the specified time-period, your conviction will be considered “spent”.

In other words, the ROA allows somebody with a spent conviction to lie to any question which, if answered truthfully, would disclose a spent conviction. Unlock will always be led by those on the ground with experience of criminal convictions. We’re only as strong and effective as those who contribute to fighting the prejudice and stigma of a criminal record. Supporting practitioners who are either advising or supporting people with criminal records into employment, volunteering and education. Explore the country’s most comprehensive source of information and support for people with criminal convictions. People with convictions may may fall victim to retaliation from someone in their past, which means insurance providers may consider them a higher risk.

Now, insurers can ask you to provide proof of your unspent convictions. They should normally do this by asking you to obtain a basic disclosure. There is a £18 cost – you should ask whether they’ll cover this cost of this. However, you might be expected to pay the cost of this as part of cooperating with the claims process. The Association of British Insurers has published a good practice guide for insurers stating that “any convictions” in fact refers to “any unspent convictions”. This fits with a High Court decision in 2002 which stated that it was an unlawful breach of statutory duty for insurance companies to rely on endorsements relating to spent convictions in order to disadvantage a driver.

Over time, this can lower the cost of insurance for honest drivers. You must also give truthful and accurate information about convictions for any other person insured to drive on the policy, for example a spouse, partner, child or parent. If you’re not asked about convictions, you don’t have to mention them, but this is very rare. If you’re not asked directly, check whether the terms and conditions mention convictions. Always get written confirmation of any convictions you’ve disclosed. What is a temporary resident visa to know if you are operating taxis, have you ever changing your feedback to disclose convictions.

The ‘rehabilitation period’ is often much longer than the sentence. Simple cautions, reprimands and final warnings are spent immediately and don’t need to be disclosed as these are not criminal convictions. An unspent conviction is one that hasn’t yet reached its defined time limit and will still come up on a basic criminal record check. Criminal convictions can be anything from a prison sentence to a speeding ticket, all types of offence count, no matter how minor.

However, as explained below, you may not actually have insurance cover and may be acting illegally. Insurers would usually also cancel the policy under these circumstances. In most cases, it will obvious where it is ‘consumer’ insurance. For example, it will normally include home buildings and contents cover, motor insurance, travel policies and life insurance.

In relation to pending prosecutions, insurers vary in their definition of this term. For example, some might mean an offence that you have been charged with, whereas others might consider an arrest enough. As a result, if the insurer asks about pending prosecutions, and you are unsure about whether you have to disclose a situation that relates to you, you should speak to the insurer for advice. However, in certain circumstances, consumers may be able to challenge the avoidance of a policy.

No comments:

Post a Comment